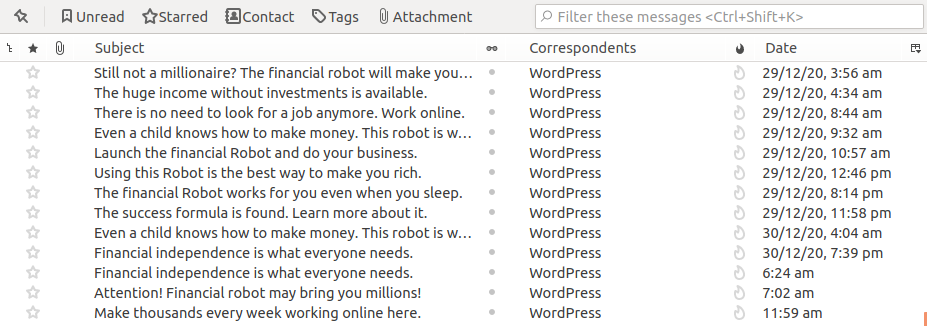

Financial spam emails ratio

If you've spent a bunch of time looking at the equity markets you probably have thought about the signals that show if we are in a stage of market mania. It definitely seems that we are in the middle of a melt-up if we go by traditional measures. That said some people say that if central banks can infinitely print in tandem that the bubbles can go on almost indefinitely because infinite freshly created money can come in from the sidelines to prop up valuations.

Something I've noticed lately is that I'm getting a much higher ratio of financial spam/scam emails lately than usual:

This got me thinking if the ratio of financial spam to general spam is a good indicator of a market in a bubble or mania phase? That said perhaps the spam filters are far better trained for things like pharmaceuticals and what is hitting my inbox is therefore a biased indicator. Perhaps the reflection of efforts put into evading the spam filters is an interesting metric itself since only the more recent efforts to evade the spam filters will reliably get past the filters.